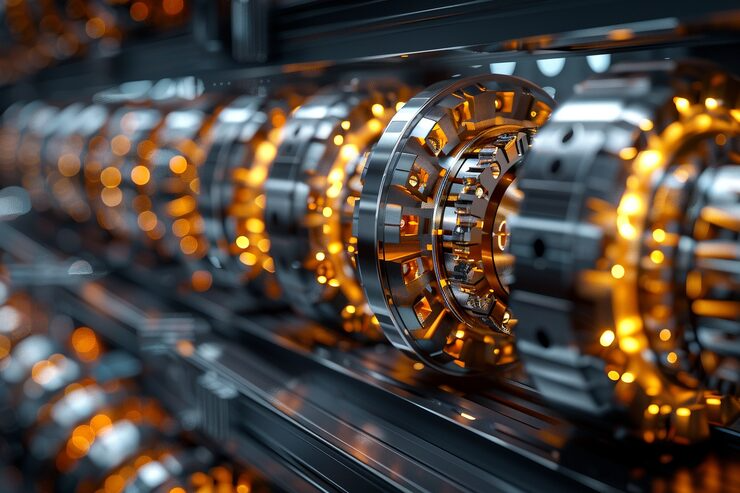

Designed for Private Equity Value Creation

Operational execution built to match the pace, governance, and return expectations of private-equity–owned manufacturing companies.

How Verifin Supports PE Value Creation

Predictable Operations

We help stabilize plant performance through disciplined management systems, frontline leadership routines, and data-backed operational visibility—reducing surprises and improving week-to-week predictability.

Faster Value Creation

Through a structured execution model, we help identify and act on operational improvement opportunities early—supporting faster value creation without sacrificing sustainability.

Board-Ready Reporting

We build KPI structures, dashboards, and operating narratives that align with private equity governance and board expectations—enabling clearer discussions and better decision-making.

A Stronger Exit Narrative

We help translate operational improvements into a clear, data-backed story that supports diligence, CIM development, and buyer confidence at exit.

Our approach is designed to improve operational performance, reduce volatility, and support stronger investment outcomes across the hold period.

Built to Work Alongside PE Teams

Verifin partners directly with investment teams, operating partners, and portfolio company leadership to support value creation initiatives—from early diagnostics through execution and exit preparation.

We help portfolio companies prepare for exit by translating operational improvements into a clear, credible, and data-backed story for buyers, lenders, and advisors.

What We Deliver:

➤ Portfolio company operational diagnostics

➤ 100-day value creation planning

➤ Execution support alongside management teams

➤ Board-level operational reporting support

➤ Exit-readiness preparation

Typical Outcomes :

➤ Stronger buyer confidence

➤ Clear operational differentiation

➤ Improved exit readiness and positioning

All engagements are conducted with strict confidentiality and aligned to the specific objectives and

governance requirements of each private equity firm.

Partner With Verifin

Let’s accelerate operational performance across your manufacturing portfolio.